capital gains tax canada calculator

The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty. How do you calculate capital gains on rental property in Ontario.

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Capital Gains 2021.

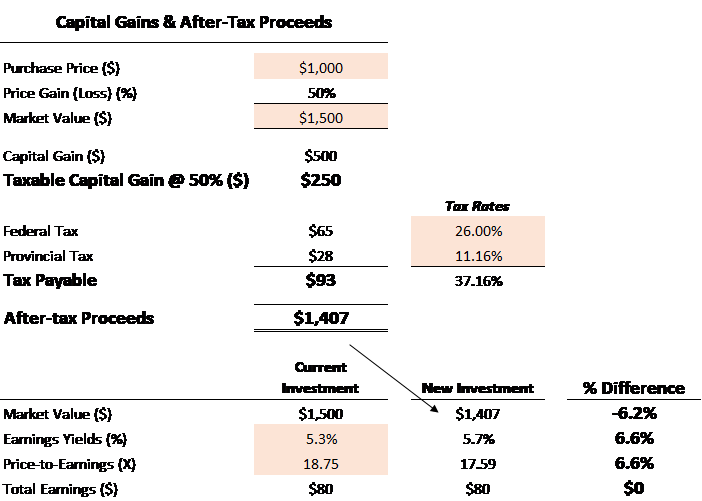

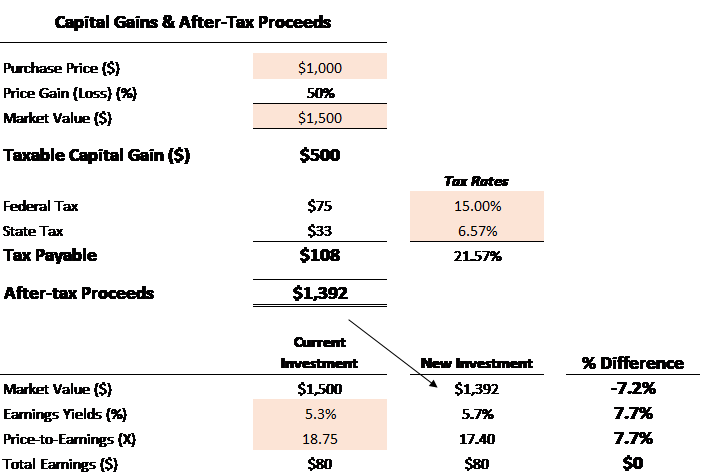

. Adjusted cost base plus outlays and expenses on disposition. Completing your tax return. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

ICalculator is packed with financial. You will need information from your records or supporting documents to calculate your capital gains or. For a Canadian who falls in a 33 marginal.

Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Calculating your capital gain or loss. New Hampshire doesnt tax income but does tax dividends and interest. Since its more than your ACB you have a capital gain.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. The Canada Annual Tax Calculator is updated for the 202223 tax year. How to calculate capital gains tax.

Capital gains tax is calculated as follows. You can calculate your Daily take home pay based of your Daily Capital Gains Tax Calculator and gross. Find out your tax brackets and how much Federal and Provincial.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain. And the tax rate depends on your income.

Mario calculates his capital gain as follows. The sale price minus your ACB is the capital gain that youll need to pay tax. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

The Canadian Daily Capital Gains Tax Calculator is updated for the 202223 tax year. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Capital Gains Tax Calculator.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. To determine if a treaty applies to you go to Status of. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

For instance if you sell a. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year. Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value.

Do not include any capital gains or losses in your business or. In 2021 if individuals taxable income is between 40400 and 60400 there is no capital gains tax to worry about. Your sale price 3950- your ACB 13002650.

High net worth individuals and investors may need to consider the. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Say you purchase a property for 250000 and you sell it for 350000 and assuming the property is buy. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say. How Do You Calculate Capital Gains On 2021.

The things you need to know to calculate your gain or loss like the inclusion rate adjusted cost base ACB and proceeds of disposition. 6500 - 4000 60.

Capital Gains Tax Calculator For Relative Value Investing

One Pager With Steps Inside Of Steps And Real Life Animation To Accompany It Investing On Autopilot Wealthsimple Investing Filing Taxes Smart Investing

Taxtips Ca Basic Canadian Tax Calculator This Very Simple Taxplanning Calculator Which Shows Marginal Tax Rates For All Provinces And Territories Now Includes The Additional Federal Personal Tax Credit For 2020 Taxcalculator

The Best Financial Certifications To Pursue In 2020 Estate Tax Capital Gains Tax Money Market

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Capital Gains Tax Calculator 2022 Casaplorer

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

Capital Gains Tax Calculator For Relative Value Investing

Simple Tax Calculator For 2021 Cloudtax

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Taxtips Ca 2017 Canadian Income Tax And Rrsp Savings Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca